[ad_1]

The oil market is at present going via one of the turbulent durations for the reason that notorious March 2020 collapse, as buyers proceed to grapple with recessionary fears. Oil costs have continued sliding within the wake of the central financial institution deciding to hike the rate of interest by a record-high 75 foundation factors, with WTI futures for July settlement had been quoted at $104.48/barrel on Wednesday’s intraday session, down 4.8% on the day and eight.8% under final week’s peak. In the meantime, Brent crude futures for August settlement had been buying and selling 4% decrease in Wednesday’s session at $110.10/barrel, a superb 9.4% under final week’s peak.

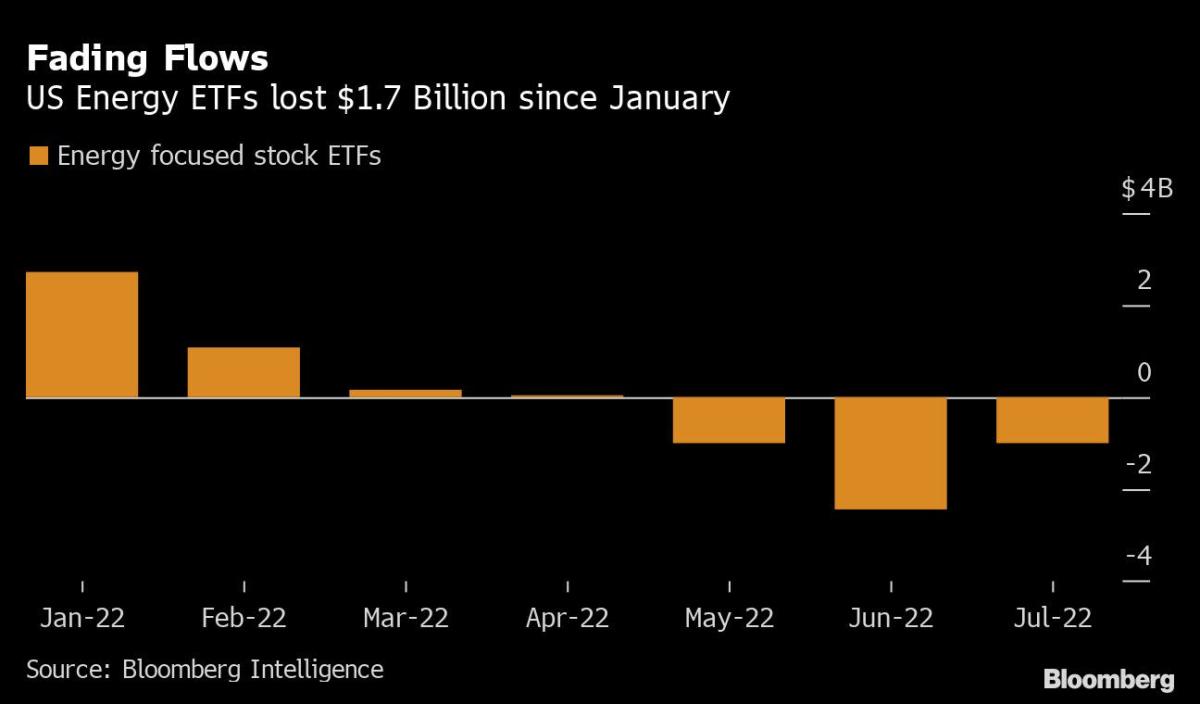

Whereas crude costs have taken a giant hit, oil and fuel shares have fared even worse, with power equities experiencing almost double the promoting stress in comparison with WTI crude.

“Yr up to now, Power is the only real sector within the inexperienced … however concern now’s that incontrovertible fact that Bears are coming after winners, thus they might take Power down. The Power Sector undercut its rising 50 DMA and now appears to be like decrease to the rising 200 DMA, which is at present -9% under final Friday’s shut. Crude Oil is sitting on its rising 50 DMA and has a stronger technical sample,” MKM Chief Market Technician J.C. O’Hara has written in a word to shoppers.

“Usually we like to purchase pullbacks inside uptrends. Our concern at this level within the Bear market cycle is that management shares are sometimes the final domino to fall, and thus revenue taking is the higher motivation. The fight-or-flight mentality at present favors flight, so we might somewhat downsize our positioning in Power shares and harvest a few of the outsized positive aspects achieved following the March 2020 COVID low,” he has added.

Associated: Russian Refinery On Hearth After Kamikaze Drone Strike

In line with O’Hara’s chart evaluation, these power shares have the best draw back threat:

Antero Midstream (NYSE:AM), Archrock (NYSE:AROC), Baker Hughes (NASDAQ:BKR), DMC World (NASDAQ:BOOM), ChampionX (NASDAQ:CHX), Core Labs (NYSE:CLB), ConocoPhillips (NYSE:COP), Callon Petroleum (NYSE:CPE), Chevron (NYSE:CVX), Dril-Quip (NYSE:DRQ), Devon Power (NYSE:DVN), EOG Assets (NYSE:EOG), Equitrans Midstream (NYSE:ETRN), Diamondback Power (NASDAQ:FANG), Inexperienced Plains (NASDAQ:GPRE), Halliburton (NYSE:HAL), Helix Power (NYSE:HLX), World Gasoline Providers (NYSE:INT), Kinder Morgan (NYSE:KMI), NOV (NYSE:NOV), Oceaneering Worldwide (NYSE:OII), Oil States Worldwide (NYSE:OIS), ONEOK (NYSE:OKE), ProPetro (NYSE:PUMP), Pioneer Pure Assets (NYSE:PXD), RPC (NYSE:RES), REX American Assets (NYSE:REX), Schlumberger (NYSE:SLB), U.S Silica (NYSE:SLCA), Bristow Group (NYSE:VTOL), and The Williams Firms (NYSE:WMB).

Tight Provides

Whereas the bear camp, together with the likes of O’Hara, believes that the oil worth rally is over, the bulls have stood their floor and consider the most recent selloff as a short lived blip.

In a latest interview, Michael O’Brien, Head of Core Canadian Equities at TD Asset Administration, advised TD Wealth’s Kim Parlee that the oil provide/demand fundamentals stay rock strong thanks largely to years of underinvestment each by non-public producers and NOCs.

You’ll be able to blame ESG—in addition to expectations for a lower-for-longer oil worth setting over the previous couple of years—for taking a toll on the capital spending of exploration and manufacturing (E&P) corporations. Certainly, precise and introduced capex cuts have fallen under the minimal required ranges to offset depletion, not to mention meet any anticipated development. Oil and fuel spending fell off a cliff from its peak in 2014, with international spending by exploration and manufacturing (E&P) companies hitting a nadir in 2020 to a 13-year low of simply $450 billion.

Even with larger oil costs, power corporations are solely rising capital spending step by step with the bulk preferring to return extra money to shareholders within the type of dividends and share buybacks. Others like BP Plc. (NYSE:BP) and Shell Plc. (NYSE:SHEL) have already dedicated to long-term manufacturing cuts and can wrestle to reverse their trajectories.

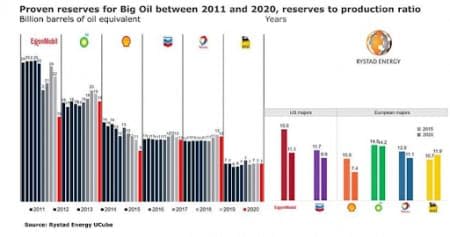

Norway-based power consultancy Rystad Power has warned that Massive Oil may see its confirmed reserves run out in lower than 15 years, because of produced volumes not being totally changed with new discoveries.

In line with Rystad, confirmed oil and fuel reserves by the so-called Massive Oil corporations specifically ExxonMobil (NYSE:XOM), BP Plc., Shell, Chevron (NYSE:CVX), TotalEnergies ( NYSE:TTE), and Eni S.p.A (NYSE:E) are all falling, as produced volumes aren’t being totally changed with new discoveries.

Supply: Oil and Fuel Journal

Huge impairment fees has seen Massive Oil’s confirmed reserves drop by 13 billion boe, good for ~15% of its inventory ranges within the floor. Rystad now says that the remaining reserves are set to expire in lower than 15 years, except Massive Oil makes extra industrial discoveries shortly.

The primary offender: Quickly shrinking exploration investments.

World oil and fuel corporations minimize their capex by a staggering 34% in 2020 in response to shrinking demand and buyers rising cautious of persistently poor returns by the sector.

ExxonMobil, whose confirmed reserves shrank by 7 billion boe in 2020, or 30%, from 2019 ranges, was the worst hit after main reductions in Canadian oil sands and U.S. shale fuel properties.

Shell, in the meantime, noticed its confirmed reserves fall by 20% to 9 billion boe final 12 months; Chevron misplaced 2 billion boe of confirmed reserves on account of impairment fees, whereas BP misplaced 1 boe. Solely Complete and Eni have prevented reductions in confirmed reserves over the previous decade.

The consequence? The U.S. shale business has solely managed to bump up 2022 crude output by simply 800,000 b/d, whereas OPEC has persistently struggled to fulfill its targets. Actually, the state of affairs has change into so unhealthy for the 13 international locations that make up the cartel that OPEC+ produced 2.695 million barrels per day under its crude oil targets within the month of Might.

Exxon CEO Darren Woods has predicted that the crude markets will stay tight for as much as 5 years, with time wanted for companies to “catch up” on the investments wanted to make sure provide can meet demand.

“Provides will stay tight and proceed supporting excessive oil costs. The norm for ICE Brent continues to be across the $120/bbl mark,” PVM analyst Stephen Brennock has advised Reuters after the most recent crude selloff.

In different phrases, the oil worth rally is likely to be removed from over, and the most recent correction would possibly provide recent entry factors for buyers.

Credit score Suisse power analyst Manav Gupta has weighed in on the shares with essentially the most publicity to grease and fuel costs. Yow will discover them right here.

In the meantime, you could find a few of the least expensive oil and fuel shares right here.

By Alex Kimani for Oilprice.com

Extra High Reads From Oilprice.com:

Learn this text on OilPrice.com

[ad_2]

Source link