[ad_1]

The Worldwide Financial Fund said of their weblog that “monetary stability dangers might quickly turn into systemic in some nations.” On this dialogue of “crypto property” and “related merchandise,” the IMF said their opinions on the steadiness of the markets, the institution of world oversight to take the reins the place nation-states are failing to halt the progress of the rising asset class, licensing, and authorization to function within the house, closing off the markets with liquidity necessities, and what they name “cryptoization” — as a result of apparently nobody knew the best way to correctly clarify hyperbitcoinization to them. Nevertheless, there’s one level I need to hit earlier than dissecting the data on this weblog put up.

Worldwide Financial Fund Credentials

If you happen to had been to go to the IMF weblog your self, you’d discover that very similar to Bitcoin Journal, the IMF has visitor contributions. That is how they describe the authors of their content material.

“IMFBlog is a discussion board for the views of the Worldwide Financial Fund (IMF) employees and officers on urgent financial and coverage problems with the day.” – IMF Weblog Residence

That being stated, you’ll sometimes discover a visitor disclaimer on the backside of a put up when it’s not of an official employees member of the IMF, or unrepresentative of the group. Let or not it’s identified that there isn’t a such disclaimer on the backside of the article in dialogue wherein all quotes, except in any other case famous, are from, “International Crypto Regulation Ought to Be Complete, Constant, And Coordinated“.

These are the authors of this specific article:

· Tobias Adrian – “Monetary Counsellor and Director of the IMF’s Financial and Capital Markets Division”

· Dong He – “Deputy Director of the Financial and Capital Markets Division (MCM) of the Worldwide Financial Fund”

· Aditya Narain – “Deputy Director within the IMF’s Financial and Capital Markets Division”

If it hasn’t been made abundantly clear at this level, this text is 100% consultant of the official place of the Worldwide Financial Fund. Now, let’s start.

Regulation And International Threat

“Crypto property and related services have grown quickly lately. Moreover, interlinkages with the regulated monetary system are rising. Coverage makers battle to watch dangers from this evolving sector, wherein many actions are unregulated. In reality, we predict these monetary stability dangers might quickly turn into systemic in some nations.”

In typical end-of-financial-times style, the IMF is “involved” about unregulated digital property. This isn’t new or a change of opinion, that is proper on par with the norm from them, however they’re clearly rising extra involved with the actions of policymakers and their thought of destabilization in sure nations consequently.

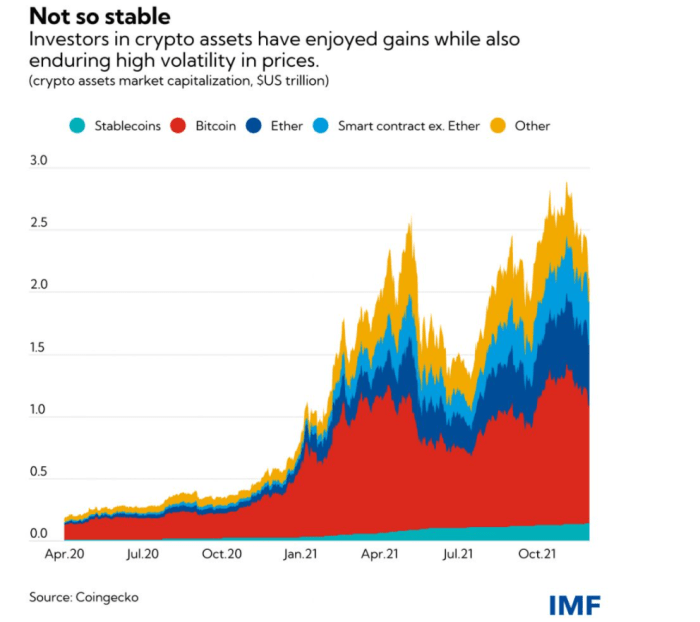

On this chart sourced by Coingecko, they attempt to signify the failure of crypto property to stabilize, however the image is painted with a dollarized brush.

Whereas there’s excessive volatility in some crypto property, most Bitcoiners will clarify that bitcoin is just not unstable. One bitcoin stays price one bitcoin, irrespective of the worth.

That is solely decided by your unit bias, or what unit you base the dedication of worth on. If you happen to worth Bitcoin in {dollars}, the greenback as a medium of alternate is very unstable with an infinite variety of models, that means you’ll worth your bitcoin as whether it is unstable. If you happen to worth Bitcoin in bitcoin, or sats, then one bitcoin is all the time one bitcoin, and a extra secure asset has by no means existed. Bitcoiners not often measure the worth of a bitcoin by its dollarized caricature.

“Cryptoization” And International Motion

“Furthermore, in rising markets and creating economies, the arrival of crypto can speed up what now we have referred to as “cryptoization”—when these property change home foreign money, and circumvent alternate restrictions and capital account administration measures.”

I’m going to be sincere; I’d by no means heard the time period “cryptoization” earlier than studying this weblog. Hyperbitcoinization? Positive, I’m assured most individuals within the Bitcoin house, or different crypto asset areas with Ethereum and their “flippening,” now we have all heard these phrases earlier than. I genuinely need to know if that is simply how out-of-the-loop these writers are on a relentless foundation, or if these are simply small gut-punches they throw out once in a while to Bitcoiners.

Discover the anger they denote in direction of the circumvention of “alternate restrictions” and “account administration measures.” This might be the equal of a cryptocurrency platform saying you’ll be able to’t day commerce with out $25,000 within the financial institution, , like stockbrokers. These are the usual strategies to maintain the lower-class the place they need them: broke and reliant on the system, in any other case why would they need to hold it round? They merely need those who should have extra, and people with out to want extra from the system.

“The Monetary Stability Board, in its coordinating function, ought to develop a worldwide framework comprising requirements for regulation of crypto property.”

China couldn’t ban it and take it down, Turkey didn’t do the identical, and Iran went after mining earlier than altering their thoughts.

These are hardly the one examples, however the level stays that none of those actions has led to unsustainable injury. In reality, they make the community stronger as those that function inside the community in locations that permit laws like this to occur are likely to migrate to locations the place they’re extra welcome.

If this framework can’t be achieved on the nation-state degree, then a worldwide initiative is required.

“The target needs to be to offer a complete and coordinated method to managing dangers to monetary stability and market conduct that may be persistently utilized throughout jurisdictions, whereas minimizing the potential for regulatory arbitrage, or shifting exercise to jurisdictions with simpler necessities.”

“Market conduct” that means they need to management who’s allowed to enter the market. “Minimizing the potential for regulatory arbitrage” means placing situations in place that permit for managed arbitrage that advantages the system, and “shifting exercise to jurisdictions with simpler necessities” means when China says they need to ban Bitcoin, they need to punish you for working miners.

“International locations are taking very completely different methods, and present legal guidelines and rules could not permit for nationwide approaches that comprehensively cowl all parts of those property. Importantly, many crypto service suppliers function throughout borders, making the duty for supervision and enforcement harder. Uncoordinated regulatory measures could facilitate probably destabilizing capital flows.”

Nation-states have failed and there is not going to be a nationwide method that works nicely sufficient to make a dent. Exchanges and repair suppliers function throughout borders, making it arduous for one nation to prosecute. The absence of a worldwide crypto asset dominance will destabilize the greenback. Translated nicely sufficient? Let’s hold shifting.

Three-Half International Regulatory Framework

1. “Crypto asset service suppliers that ship vital features needs to be licensed or approved. These would come with storage, switch, settlement, and custody of reserves and property, amongst others, much like present guidelines for monetary service suppliers. Licensing and authorization standards needs to be clearly articulated, the accountable authorities clearly designated, and coordination mechanisms amongst them nicely outlined.”

The IMF desires to be Oprah with licenses. “You get a license! And also you! And also you over there mining your Bitcoin, you get a license too!”

· “Storage” that means pockets suppliers or custodial providers.

· “Switch” that means the creation or mining of a block that facilitates a switch of funds, or being a Layer 2 operator that transfers funds.

· “Settlement” which might be the validation course of, the method of working a node for the community which finalizes transactions, or presumably custodial settlement for exchanges.

· “Custody Reserves” is only a custodial service.

Does the language appear ambiguous? That’s as a result of it’s. The intention is to be open-ended, so whereas it would look like these phrases are being stretched to satisfy a definition, that’s completely their intent.

What does including licensing to open a node or a single miner do to the ecosystem? Right, it centralizes towards those that can afford licensing (and are keen to give up their rights to privateness), including extra boundaries of entry, preserving folks out.

2. “Necessities needs to be tailor-made to the principle use circumstances of crypto property and stablecoins. For instance, providers and merchandise for investments ought to have necessities much like these of securities brokers and sellers, overseen by the securities regulator. Providers and merchandise for funds ought to have necessities much like these of financial institution deposits, overseen by the central financial institution or the funds oversight authority. Whatever the preliminary authority for approving crypto providers and merchandise, all overseers — from central banks to securities and banking regulators — have to coordinate to handle the assorted dangers arising from completely different and altering makes use of.”

Discover using legacy monetary institutional terminology to bridge comparisons between crypto property. The IMF could be very clearly lining out the best way to management this international market, identical to they’ve been since 1944, through the use of the system they already know. They need each central banking system, regulator, and market maker working collectively to manage the market that they’ve brazenly admitted has the chance to destabilize the present system.

3. “Authorities ought to present clear necessities on regulated monetary establishments regarding their publicity to and engagement with crypto. For instance, the suitable banking, securities, insurance coverage, and pension regulators ought to stipulate the capital and liquidity necessities and limits on publicity to several types of these property, and require investor suitability and threat assessments. If the regulated entities present custody providers, necessities needs to be clarified to handle the dangers arising from these features.’’

Regulate engagement to cryptocurrency. “Stipulate the capital and liquidity necessities,” “require investor suitability and threat assessments.”

They can not make it clearer that they merely need to management who can and can’t play within the house. Cash is just for those who have already, and so they need to set the principles with a purpose to just remember to can’t play.

“Some rising markets and creating economies face extra speedy and acute dangers of foreign money substitution by means of crypto-assets, the so-called cryptoization. Capital move administration measures will should be fine-tuned within the face of cryptoization. It’s because making use of established regulatory instruments to handle capital flows could also be tougher when worth is transmitted by means of new devices, new channels and new service suppliers that aren’t regulated entities.”

“New devices”. What might that imply? Nicely the IMF wasn’t proud of the choice of El Salvador to undertake Bitcoin. Since there has solely been one nation-state to take this degree of adoption, now we have to deduce that on a sure observe, they’re speaking about El Salvador. So, a “new instrument” might be the Chivo pockets: a government-operated custodial crypto pockets.

“New channels” might be referring to the Lightning Community, a Layer 2 software constructed on high of Bitcoin that enables for fast switch of worth, which broadcasts all transactions on-chain as soon as the channel is closed, that’s accepted by the Chivo pockets.

“New service suppliers” decide one. My cash is they’re speaking about platforms like Strike.

In Closing

“There may be an pressing want for cross-border collaboration and cooperation to handle the technological, authorized, regulatory, and supervisory challenges. Establishing a complete, constant, and coordinated regulatory method to crypto is a frightening process. But when we begin now, we will obtain the coverage purpose of sustaining monetary stability whereas benefiting from the advantages that the underlying technological improvements deliver.”

The IMF simply desires to ensure THEY are those benefiting from cryptocurrency positive factors and adoption, in addition to permitting all of their pals that already management the biggest parts of wealth on this planet to return and stick their fats faces into this rising digital pie.

Go try why the IMF and World Financial institution are principally Shaggy & Scooby Doo on this different article concerning the IMF hating Bitcoin.

It is a visitor put up by Shawn Amick. Opinions expressed are solely their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.

[ad_2]

Source link