[ad_1]

The official ending of the U.S.-led warfare in Afghanistan leaves a lot of long-term questions, together with how the nation can construct a functioning financial system. Now that U.S. help has evaporated and worldwide help is basically shut off, what choices does Afghanistan have?

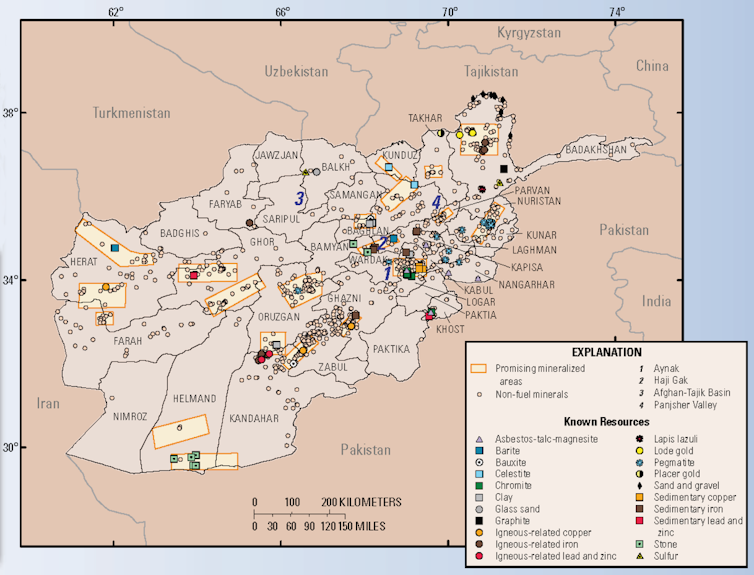

One risk resides in pure sources. Afghanistan possesses a wealth of nonfuel minerals whose worth has been estimated at greater than US$1 trillion. For millennia the nation was famend for its gems – rubies, emeralds, tourmalines and lapis lazuli. These minerals proceed to be regionally extracted, each legally and illegally, in principally small, artisanal mines. Much more worth, nonetheless, lies with the nation’s endowments of iron, copper, lithium, uncommon earth parts, cobalt, bauxite, mercury, uranium and chromium.

Whereas the entire abundance of minerals is definitely huge, scientific understanding of those sources remains to be at an exploratory stage. Even with a greater understanding of how rewarding their extraction is likely to be, the presence of those sources won’t present a jump-start to a brand new financial system. As a geologist who has studied the extent of their sources, I estimate a minimal of seven to 10 years will likely be wanted for large-scale mining to grow to be a significant new income.

USGS follows the Soviets

British and German geologists performed the earliest fashionable surveys of Afghanistan’s minerals within the nineteenth and early twentieth centuries. However it was the Soviets within the Sixties and Nineteen Seventies who carried out probably the most systematic exploratory work all through the nation, producing a big physique of detailed data that stood because the spine to more moderen research.

From 2004 to 2011, the U.S. Geological Survey performed an in depth evaluate of accessible knowledge, including new data from its personal aerial survey, restricted area checking and from the Afghanistan Geological Survey. This work higher recognized mineral websites, richness and abundance.

Nobody who examines this work, as I’ve, can ignore the large-scale exploratory effort by Soviet scientists. Detailed area mapping and large sampling, together with tens of 1000’s of meters of borehole drilling, and lab analyses have been carried out. Given the money and time invested, it might seem high-level plans have been in play to develop Afghanistan’s minerals as soon as the nation was below Soviet affect.

Primarily based largely on this data, the USGS delineated 24 areas within the nation and estimated their mineral abundance. Knowledge packages have been ready on all 24 areas for firms to make use of as a foundation for making bids to use any sources.

Chinese language and Indian firms expressed sturdy curiosity, and precise concessions have been granted. Arguments over contract phrases and considerations about safety, nonetheless, have stalled exercise because the late 2010s.

Mineral abundance

How a lot mineral abundance does Afghanistan even have? I’ll attempt to reply this with a quick abstract of USGS estimates for metals of particular curiosity: copper, iron, lithium and uncommon earth metals. Geoscientists who have been a part of the USGS effort have famous that their figures are “conservative” but additionally “preliminary.”

Regardless, it’s secure to say the sources in whole are large. Complete copper sources for all identified deposits sum to about 57.7 million metric tons. At present costs, the useful resource worth is $516 billion. These are “undiscovered” sources – recognized however not absolutely explored and assessed. If additional research have been to evaluate them recoverable at a revenue, they might rank Afghanistan among the many prime 5 nations for copper reserves on the earth.

United States Geological Survey

The most important copper deposit, which additionally incorporates vital quantities of cobalt, is the Aynak ore physique, positioned about 18 miles (30 kilometers) southeast of Kabul. After the Soviet Union invaded Afghanistan in 1979, the Soviets started growth of the mine but it surely was suspended in 1989 following Soviet withdrawal from the nation. The high-grade portion of the entire Aynak deposit is estimated at 11.3 million metric tons of copper, value $102 billion at present market costs.

Afghanistan additionally has world-class iron ore sources, concentrated within the Haji Gak deposit of Bamiyan Province. Haji Gak has an estimated 2,100 million metric tons of high-grade ore that’s 61%-69% iron by weight. At present value ranges, this represents a price of $336.8 billion, inserting Afghanistan among the many prime 10 nations worldwide in extractable iron.

Lithium sources in Nuristan Province, which happen as veins, impressed Soviet geoscientists with the quantity of exhausting rock ore (lithium can also be mined from brine). Primarily based on USGS estimates, it’s a vital however modest useful resource in right now’s phrases, as exploration for such deposits has elevated around the globe up to now decade.

Lastly, uncommon earth parts exist in southern Helmand Province. These deposits primarily comprise cerium, with smaller quantities of extra beneficial lanthanum, praseodymium and neodymium, totaling maybe 1.4 million metric tons. Two of those, praseodymium and neodymium, are at excessive value ranges – greater than $45,000 per metric ton – and make distinctive magnets utilized in motors for hybrid and electrical vehicles, however the abundance of those parts isn’t massive relative to how a lot different nations have.

Above-ground components and geopolitics

Mining knowledge holds that what’s within the floor is much less necessary than what’s above floor. Market realities, safety, contract phrases, infrastructure and environmental considerations matter greater than sheer abundance as to whether sources may be developed.

Amongst these components, maybe probably the most related at current is robust world demand for the metals, notably copper, lithium and uncommon earth parts, that are important to the rising markets in renewable vitality and electrical automobiles.

Jerome Starkey/flicrk, CC BY-SA

Whether or not or not Afghanistan can start mining these parts will rely upon what the brand new Taliban authorities does. Underneath the previous Ministry of Mines, a $2.9 billion contract for a portion of the Aynak copper deposit was granted to 2 state-owned Chinese language firms. The 30-year contract signed in 2007 had a excessive royalty charge by world requirements and required that ore smelting and processing be completed regionally. Different situations included constructing a 400-megawatt coal energy plant and a railway to the Pakistan border. Additionally stipulated was that 85%-100% of workers, from expert labor to managerial personnel, be Afghan nationals inside eight years of the date work begins. Although initially agreed to, these phrases have been later declared onerous by the businesses, halting growth.

[Get the best of The Conversation, every weekend. Sign up for our weekly newsletter.]

Although roads exist to many ore deposit areas, Afghanistan lacks good-quality roadways, railways and electrical energy. Mining firms aren’t any stranger to such challenges, but the scenario is heightened on this case by rugged terrain and the landlocked nature of the nation. Railways, particularly, could be important for transporting ore, uncooked or refined, to international markets.

There are additionally environmental and cultural considerations. Mining can lead to main impacts to land and air high quality, in addition to watersheds – a specific concern in water-poor Afghanistan – if not regulated to greatest practices. No much less, enforcement of such requirements is required and has been an issue in lots of lower-income nations.

Near the Aynak copper deposit is a big web site of Buddhist relics, statues, temples and stupas. There are additionally Bronze Age mining websites that represent necessary archaeological sources. Right here, too, no readability but exists about how Taliban leaders, who ordered the destruction of the good Buddhist statues at Bamiyan in 2001, would possibly view these websites.

For Afghanistan, its sources may imply a supply of long-term international funding, skill-building and infrastructure growth, all important for a sustainable financial system. However a significant query is which firms could be concerned. Afghanistan can also be on the middle of geopolitical struggles, involving each India and Pakistan, in addition to China, Iran and the U.S. That the Taliban at the moment are in management doesn’t make the nation’s minerals any much less invested with massive significance.

Creator’s be aware: In 2015, I used to be the teacher for a process power class within the Henry M. Jackson College of Worldwide Research on the College of Washington that produced a report on Afghanistan’s pure sources and the opportunity of their performing as a foundation for financial growth. This text is dedicated to the superb work completed by college students on that process power.

This text was up to date to appropriate particulars about growth of mining operations by the Soviets.

[ad_2]

Source link